If you’re involved in the car industry or have an interest in EVs, then the chances are that you know about the Zero Emissions Vehicle (or ZEV) Mandate. But it will be crucial in 2024 about what car you might want to buy – and crucially might not be able to buy.

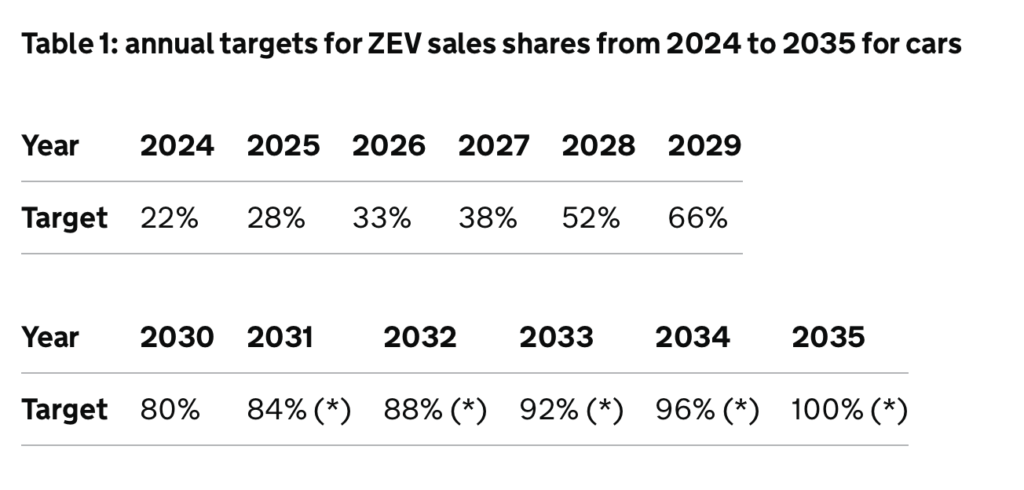

Starting from this year, the ZEV Mandate essentially states that in 2024 at least 22 per cent of new car sales sold by every car manufacturer in the UK must be an EV. This rises to 80 per cent in 2030 then up 100 per cent by 2035.

For all EV brands such as Polestar or Tesla, that obviously won’t be a problem. It may also not be a problem for some mainstream brands such as MG that have developed strong electric-only sales. Where it does become an issue however is for those brands who little or no EV presence in the market. And all these terms are also relative. At the time of writing, around 16% of the UK new car market are EVs. So to meet that 22%, they need to outperform the market, by some margin.

Thankfully, there are some escape clauses for manufacturers, some well known, but others that are only now coming to light. The first, and least palatable, is that for every vehicle sold over and above that 22%, the car manufacturer will pay a fine likely to be around £15,000 per vehicle.

In reality, this is unlikely due to the second clause which is that manufacturers can trade ‘credits’ between each other to help them reach that 22%. So for Tesla and Polestar, in 2024, potentially 78% of their sales could represent credits to trade to other manufacturers. Some, such as Stellantis or the VW Group, will want to pool all of their credits among their brands accordingly, but others without any EV in their range (think Suzuki for instance) will struggle a little more.

Will they need to purchase those credits and what will their market rate be? This is where the next clause comes in. If they over-perform above the mandate’s percentage then a company can also bank that credit for future years. In the same manner but in reverse, if they under-perform they can also borrow from future years – especially handy if you know you have a potentially big-selling EV coming the following year. However, both the banking and borrowing of those credits can only be done for three years.

The final step is the one that has been least publicised which regards what is called ‘offset non-compliance’. In effect, this takes a historical snapshot of an individual manufacturer’s average CO2 emissions from its new car sales in 2021. During the first three years of the ZEV Mandate (2024 to 2026), if a manufacturer is able to demonstrate that their CO2 emissions average of their new car sales has dropped below that 2021 figure, this can be used to partly offset those cars that have.

How does this work in practice. Let’s say a manufacturer has sold only 8% EVs by the end of 2024 so 14% short of that magic 22%. However, let’s also pretend that the average C02 emissions of their total overall sales have dropped by 50% compared to that 2021 figure we mentioned. As a result, that percentage is applied to that non-compliance percentage, meaning that 14% actually becomes 7%. And then suddenly all of those other solutions, mentioned above, become rather more palatable than before.

The result is that even companies such as Mazda, with the MX30 its only full EV in its range, may be able to find a work around.

Interviewing Mazda UK’s Managing Director, Jeremy Thomson, on the ZEV Mandate, Thomson insisted that Mazda would “continue to give customers multi-solution options for their choice of cars and, through careful management of sales options would be penalty free.”

What’s for certain however, is that whatever route a manufacturer choose to go down, as we get closer to the end of 2024, at some manufacturers there is going to be lots of tapping of calculator keys and working out of figures to ensure the best – and crucially, cheapest – routes to meet the ZEV mandate.

And the result, if you’re buying a new car, might mean that your next new car might be the choice of a sales person or an accountant in head office, not your own…