Forget April Fool’s Day, new and existing drivers of electric vehicles are going to be in for a rather nastier surprise come 1 April 2025.

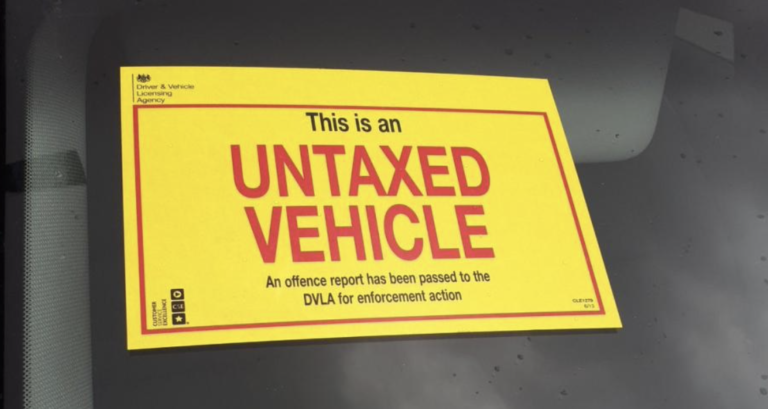

The reason is that on that day, the Government’s new Vehicle Excise Duty (VED) changes, known more commonly as road tax, come into force.

While any zero-emission vehicle has until now not paid any road tax, from 1 April, that will change for both new and older cars. Effectively, the Government has removed the £0 rated Band A from the graduated system.

Where this gets tricky depends on the age of the EV. If it was registered between 1 March 2001 and 31 March 2017, there will currently be a payment of £20 (but the Government has already warned that this may change for 2025).

If it was registered from 1 April 2017 until 31 March 2025, these cars will pay the standard rate that is now £190 but again is subject to change for 2025. For any cars registered new after 1 April 205, they will pay the lowest rate of vehicle tax (again, currently £20 but this may change), but then £190 from the second tax payment onwards. The £10 discount for hybrids is removed.

There’s more bad news too. If your new car costs £40,000 or more, then the £410 Expensive Car Supplement also applies for years two to six and this is on top of the existing rate. That means that for those five years, your road tax will be £600 at the current rate.

And before you think that £40,000 is a lot to be spending on a new car, it’s an easy bracket to get into even with relatively humble cars such as the Hyundai Ioniq 5 or Volkswagen ID3. And remember that charge applies until the car is six years old – so a potential shock for those looking to buy a secondhand EV after three years.

The Government’s thinking is simple. As the number of EVs on British roads grow, it is losing funds earned from road tax on them at the current zero rate. The only problem is that it withdraws another incentive to buy an EV, the rate of road tax is the same for any vehicle, ICE or EV, albeit with the first year rate growing with the car’s CO2 rating. For those years two to six however, it costs the same amount to tax an EV as any other car on the road.

As car manufacturers currently struggle to reach their 22% of EV sales demanded by the ZEV Mandate, they will feel that new EV buyers, especially retail customers need all the encouragement they can get rather than any discouragement, like this.

Whether the new Labour Government has any appetite to make any changes before April is yet to be seen.